There’s a palpable excitement in the market as the spring selling season nears. The Fed may have kept rates on hold, but the market is expecting interest rate cuts in the near future. After two years of 15–20% pa declines in transaction volumes, there could be a big rush if mortgage rates drop significantly.

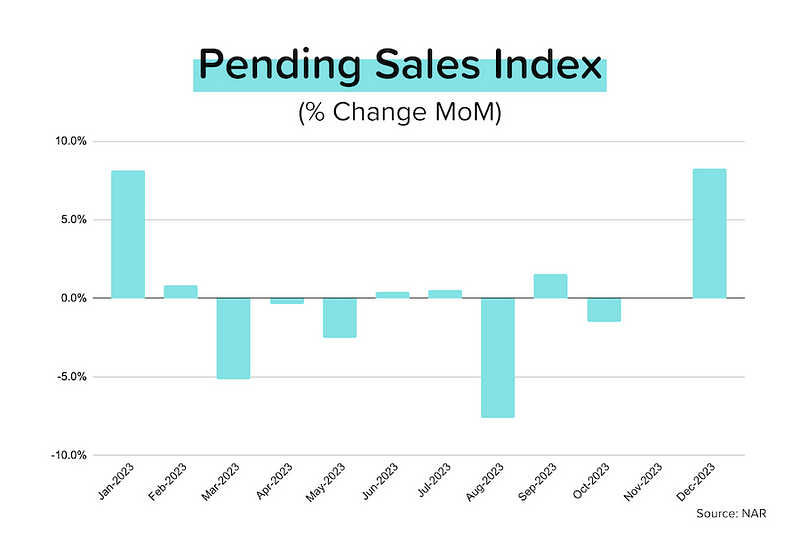

Finally the bottom? After many months of declines, pending home sales for December 2023 jumped 8% month-over-month, as buyers reacted to the fall in mortgage rates. [NAR] But could this just be another ‘head fake’ like we had in January 2023? With inflation approaching the Fed’s target (rate cuts ahead), and inventory levels rising (more homes to sell), I’d say ‘no.’

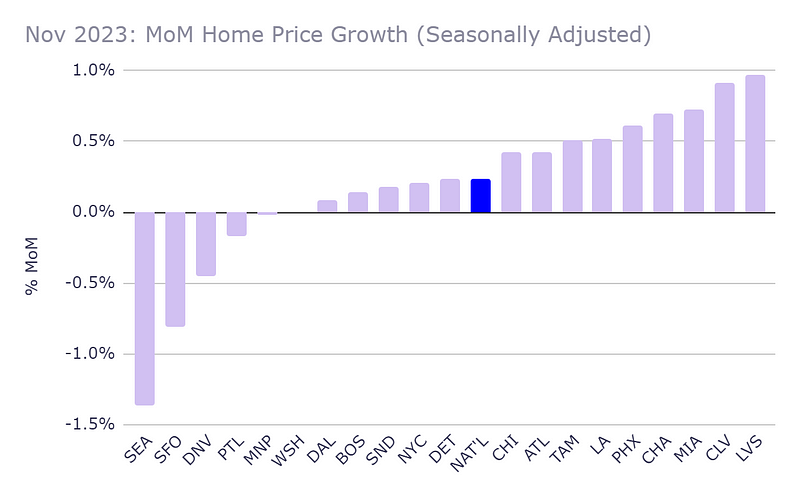

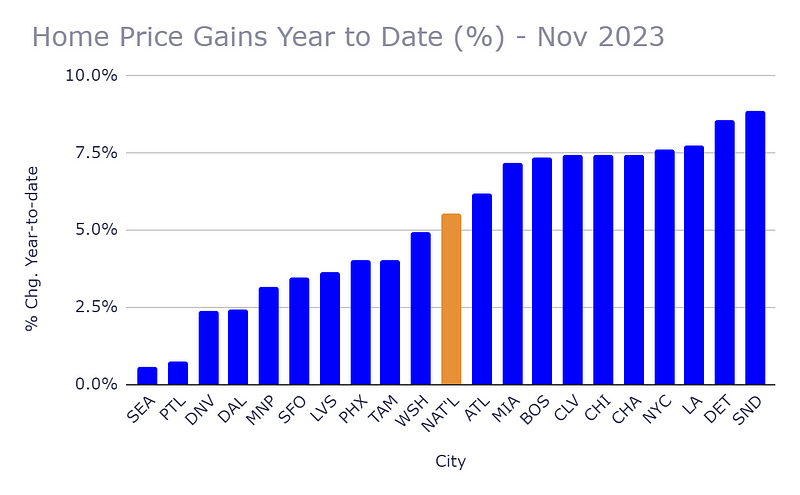

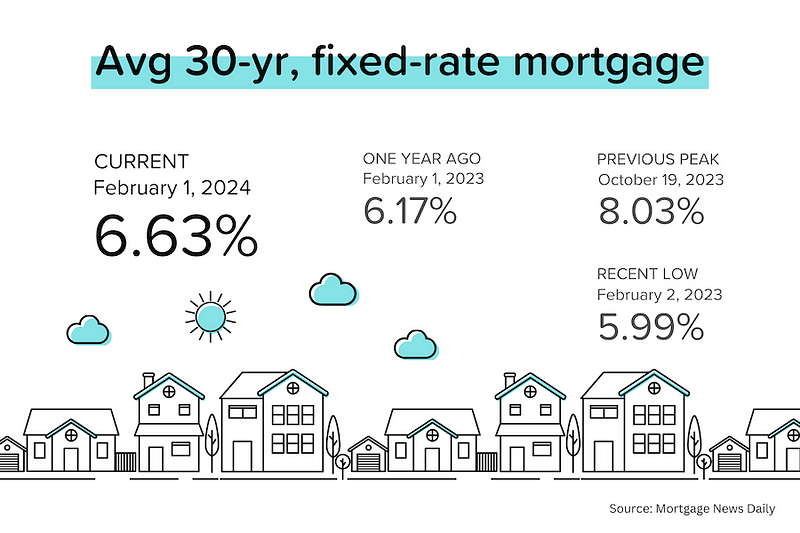

A ‘double dip’ to end the year? The Case-Shiller national home price index for November 2023 rose 0.2% month-over-month on a seasonally-adjusted basis. But on an unadjusted (raw) basis, prices fell 0.2% MoM. Keep in mind that average 30-yr mortgage rates were at their peak in Oct/Nov, and have since fallen more than 150 basis points (1.5%). [S&P DJI]

Four of the big city indexes (Denver, Portland, Seattle, and San Francisco) showed seasonally-adjusted declines ranging from 0.2% to 0.8% MoM. On a raw basis, 12 out of 20 city indexes saw prices drop, with prices falling 1.3% MoM in San Francisco and 1.4% MoM in Seattle. [S&P DJI]

The FHFA national price index for November 2023 rose a similar 0.3% month-over-month on a seasonally-adjusted basis. The New England region saw prices fall 0.2% MoM, while prices in the West North Central region and East South Central were flat. [FHFA]

Rental rates stay lower. In January 2024, rental rates declined month-over-month for the 6th-straight month, and have now been in negative territory on a year-over-year basis for eight straight months. Why does this matter? This tells us that the large “shelter” cost component of both CPI and PCE (inflation) will continue to trend lower. [Apartment List]

Jobs week started with a JOLT. The number of job openings climbed in December 2023 to a higher-than-expected 9.03 million, and the November 2023 figure was revised higher. The “quits rate” remained at 2.2%?—?the same level as pre-pandemic. Workers are staying put. [BLS]

Then ADP’s monthly employment report showed that private employers added 107,000 jobs in January 2024, well below expectations of 150,000. Annual wage growth for job stayers dropped to +5.2% (from +5.4%), while wage growth for job changers fell to +7.2% (from +8.0%). That’s the lowest premium for changing jobs (7.2%?—?5.2% = 2.0%) on record. [ADP]

The optimistic consumer. The Conference Board’s Consumer Confidence Index jumped from 108 to 114.8 in January 2024, the highest level in two years. Why were shoppers more sanguine? Expectations for lower inflation, lower interest rates, and secure jobs. [Conference Board]

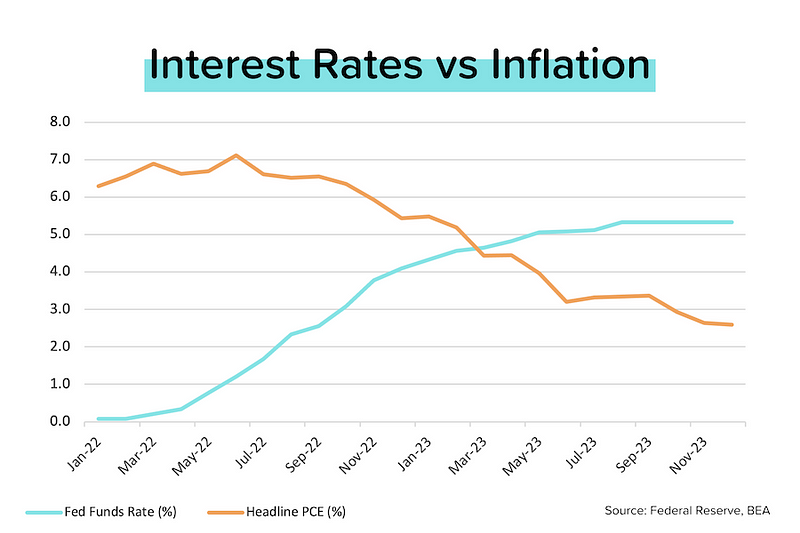

The Fed kept rates on hold for the fourth-straight meeting. While inflation is approaching their 2% target, the US economy and jobs market remains very strong. The last time the Fed raised rates was in July 2023! [Federal Reserve]

Note: The Bureau of Labor Statistics’ big jobs report for December 2023 comes out this morning. There’s a decent chance that it “surprises” on the upside (more apparent jobs growth) because of annual statistical adjustments that the BLS makes each January.

Pending Sales and Last Year’s ‘Head Fake’

If you’re a forecaster, it’s really important to be honest with your readers. Last year around this time, we got a big jump in pending sales (+8.1% MoM in January 2023), and I wrote about the “inflectious” excitement of the market finally bottoming.

That proved to be dead wrong. Instead, fast-rising mortgage rates killed the incipient recovery. The spring selling season sucked, and we ended up with existing home sales down 19% YoY in 2023.

Well here we are again. Pending home sales for December 2023 jumped a similar 8.3% MoM. So is this going to be another ‘head fake?’ I don’t think so. Here’s why:

- Inflation was still rising and the Fed was still hiking rates in January 2023. Neither stopped until July 2023. Now the Fed is on the verge of cutting rates.

- The ‘overshoot’ of home sales in 2020 and 2021 has been neatly balanced by the ‘undershoot’ of home sales in 2022 and 2023. The average annual transaction volume for 2020–2023 was 5.2 million units. The average for 2012–2019? 5.2 million units.

- Life keeps happening (the 5 Ds: diplomas, diamonds, diapers, divorce and death) and decisions have been delayed over the last two years.

- People are getting accustomed to 6% mortgage rates, and have no expectation that rates are going to drop back down into the 3s anytime soon.

On the Case (Shiller)

Let me be clear: this was NOT a strong set of numbers. But you have to remember that Case-Shiller’s November data release includes transactions from Sep-Oct-Nov, and average 30-yr mortgage rates briefly exceeded 8% in mid-October.

On an unadjusted (raw) basis, the price movements looked like the beginning of a ‘double dip’?—?a second downward trend:

- 12 out of 20 big city indexes declined month-over-month, with 5 cities seeing declines of around 1%. In November 2022 (during the last downturn in prices), 14 out of 20 city price indexes dropped.

- The national index declined 0.2% month-over-month. That’s the first negative result since January 2023.

On a seasonally-adjusted basis, the results looked a bit better:

- Only 4 out of 20 big city indexes declined month-over-month, with only two (Portland and San Francisco) down year-over-year.

- The national index increased 0.2% month-over-month and is now up 5.4% year-to-date (through November), suggesting a 2023 appreciation figure of ~5.5%.

So will there be a real double dip in prices? Probably not at the national level. Mortgage rates have dropped nearly 1.5% in the last few months, and we’ve got the spring upturn approaching with inventory levels still low. But if you live in a market where new home/apartment completions are running hot, flat-to-negative prices are definitely possible.

Don’t Worry Too Much About the Fed

The Fed WILL begin to cut interest rates this year. Two times, three times, starting in March or May?—?who knows? With inflation (“core” PCE is what they obsess over) running at 2.9% YoY in December 2023, and a strong tailwind from falling shelter cost growth, it’s really just a question of time.

Here are a few things for you (and your clients) to keep in mind:

- The Fed doesn’t set mortgage rates. The market does. And the market will move well in advance of Fed action.

- You’re not going to outthink everyone else in America. When mortgage rates move below 6.5%, you and millions of other people are going to start thinking ‘it’s time!’

- Home prices will continue to rise. Price appreciation in 2023 was about 6%?—?that’s $24,000 in equity value gained on a $400,000 house. Price appreciation in 2024 will probably be less than that, but there will still be a significant ‘cost of waiting.’

“It’s not about timing the market, it’s about time IN the market.”

Mortgage Market

On Wednesday, the Fed decided to keep rates steady at 5.25–5.50%, and Chairman Jerome Powell stated that a rate cut was “unlikely” in March. The Fed is supposed to be transparent, but the signals have been very mixed lately:

- Fed members’ own forecasts are calling for multiple rate cuts this year

- Powell himself has said that the Fed “doesn’t have to wait” for inflation to hit their 2% target to begin cutting rates

- On an annualized basis, “core” PCE over the last 6 months is ALREADY at their target.

The next Fed rate decision is on March 20. The Fed Funds futures market is currently pricing in a 56% probability that the Fed will do nothing, a 43% chance of a 25 bps cut, and a 1% chance of a 50 bps cut. If it doesn’t happen in March, the market is pricing in a near 100% probability of cuts in May.

They Said It

“The housing market is off to a good start this year, as consumers benefit from falling mortgage rates and stable home prices. Job additions and income growth will further help with housing affordability, but increased supply will be essential to satisfying all potential demand.”?—?Lawrence Yun, NAR Chief Economist.

“The [Case-Shiller] house price decline [in November] came at a time when mortgage rates peaked, with the average Freddie Mac 30-year fixed rate mortgage nearing 8%, according to Federal Reserve data. The rate has since fallen over 1%, which could support further annual gains in home prices.”?—?Brian D. Luke, Head of Commodities at S&P DJI

“Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay. Wages adjusted for inflation have improved over the past six months, and the economy looks like it’s headed toward a soft landing in the U.S. and globally.”?—?Nela Richardson, ADP’s Chief Economist.